Advanced Electric Machines (AEM), a leader in sustainable motor manufacturing primarily for the automotive industry, announces it has secured £23 million of new investment.

The funding will be used to scale up production capacity at its facility in the North East, deliver on ambitious growth plans to establish a global sales footprint, and bolster R&D capabilities.

The Series A funding round was led by Legal & General Capital and Barclays Sustainable Impact Capital with significant additional investment from Par Equity. Other investors included Northstar Ventures, the Low Carbon Innovation Fund 2 and Turquoise Capital LLP.

AEM’s motor technologies remove the need for polluting rare earth metals in electric vehicle (EV) motors, the production and processing of which is concentrated in China. By eliminating rare earth permanent magnets, costs as well as reliance on geographically concentrated supply chains are reduced, and recyclability and environmental footprint of the motor is significantly improved.

AEM’s advanced technology will enable leading passenger and commercial electric vehicle manufacturers to reduce their environmental impact and dependence on critical supply chains, without compromising on quality and performance. Historically, engineers have struggled to match the performance of rare earth permanent magnet motors when attempting to develop alternatives. AEM’s technology overcomes these challenges, while reducing the environmental impact.

The investment will enable AEM to:

- Scale up production capacity at its manufacturing facility in the North East, creating 40 new skilled green jobs in the next two years.

- Establish a global sales and service footprint, accelerating the rollout of its innovative motor solutions. AEM’s HDSRM motor, designed for commercial vehicles, is already in production and in vehicles of customers across the UK, Europe, North America and APAC.

- Accelerate the progress in the development of its SSRD motor for passenger vehicle segment. The SSRD has been developed with the support of Innovate UK, the Advanced Propulsion Centre and leading academic and automotive partners, including Bentley Motors.

- Bolster R&D capabilities to bring its copper-free motor to production, which will further improve recyclability and move AEM closer to the goal of being the world’s most sustainable electric motor manufacturer.

Steven Poulter, Head of Principal Structuring and Investments at Barclays, will join the Board of AEM.

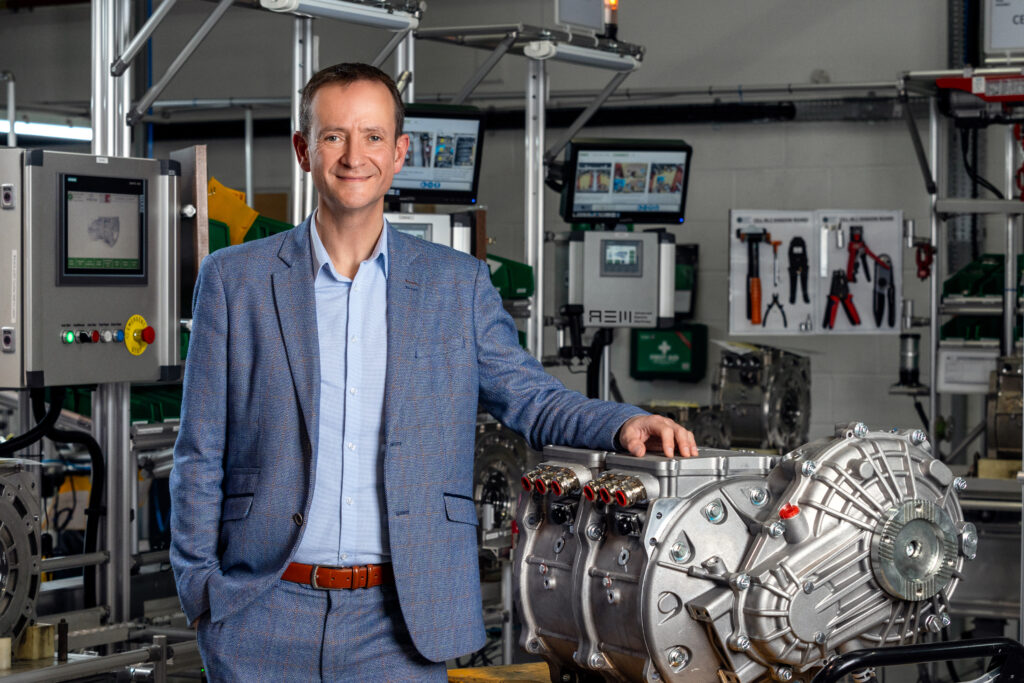

Prof. James Widmer, CEO and co-founder of Advanced Electric Machines, said: ‘Today’s funding announcement clears our path to sustainable growth for years to come. It is a vote of confidence from the market in our vision, our technical capabilities and our mission to rid EV motors of harmful and problematic materials. Everyone at AEM and our new partners are excited for the role we are now able to play in making the electric vehicle sector truly sustainable.’

John Bromley, Managing Director – Clean Energy Strategy & Investments at Legal and General Capital, said: ‘Legal & General Capital invests in innovative businesses with the potential to accelerate progress to a low-carbon economy. AEM’s technology provides a sustainable, market-leading solution capable of eliminating the need for rare earth materials, thereby reducing emissions and supply chain risk. The UK has a long and successful history in cutting edge automotive technologies and by co-leading this investment, we are supporting AEM to fulfil its potential to create skilled jobs and generate global export revenues.’

Steven Poulter, Head of Principal Structuring and Investments, Barclays, said: ‘AEM is solving a fundamental constraint of the EV market – the reliance on rare earth metals for motors – which causes significant cost and supply chain challenges. By producing motors that don’t rely on these metals, AEM is able to remove the key barriers to the production and subsequent adoption of EVs. We are excited to be supporting AEM on the next stage of its journey as it expands into passenger vehicles, a growing market critical to the energy transition.’

Andrew Noble, Partner at Par Equity, said: ‘AEM has designed and built an electric powertrain motor which is greener, faster and more efficient than the incumbent solutions, resulting in significant market pull and potential for growth. It has all the ingredients of the type of business Par Equity likes to back, and we’re excited to partner with AEM at this critical stage as the company scales its team and capabilities to service a large and rapidly growing EV market.’

Learn more about Advanced Electric Machines at: www.advancedelectricmachines.com

-ENDS-

About AEM

Advanced Electric Machines’ vision is to design and build the world’s most sustainable EV motors for the global automotive and transport sectors. It utilises its expertise in materials, manufacturing and design to ensure its solutions are not only more sustainable, but also more efficient and cost-effective.

Based in the North East of England, Advanced Electric Machines Limited was founded in 2017, when it was spun out from Newcastle University’s world-class electric motor research team, led by AEM’s CEO, Dr James Widmer, and CTO, Dr Andy Steven.

AEM technologies are covered by 46 international patents protecting their unique motor designs and manufacturing processes around the world.

About Legal & General Capital

Legal & General Capital (LGC) is Legal & General Group’s alternative asset platform, creating assets for Legal & General Retirement and third-party clients in order to achieve improved risk-adjusted returns for our shareholders. LGC has built its capabilities in a range of alternative sectors, including in residential property; specialist commercial real estate; clean energy; alternative credit; and venture capital, which are all supported by long-term structural growth drivers, meet a financing gap and respond to a scarcity of supply that is underpinned by enduring societal needs.

Its purpose is to invest society’s capital for society’s benefit. Investing in the real economy and supporting the Group’s focus on climate and inclusive capitalism, LGC’s investments create jobs, change lives and contribute towards a net zero carbon future.

Legal & General has invested over £29bn in levelling-up regional economies, including through major UK-wide regeneration schemes and has recently made a commitment to enable all its new homes to operate at net zero carbon emissions from 2030.

About Barclays Sustainable Impact Capital

As part of the firm’s broader commitments, Barclays will invest £500m of its own capital, led by the Principal Investments team, in fast-growing, innovative, environmentally-focused companies whose values are aligned with those of Barclays and which target the goals and timelines of the Paris Agreement. Investments will be strategic to Barclays, its clients and the communities it serves, with clear scalable propositions that deliver both environmental benefits and economic returns. To find out more, click here.

About Par Equity

Par Equity is a leading venture capital firm, based in Edinburgh, investing in innovative technology companies with high growth potential, in the North of the UK. Since it was founded in 2008, Par Equity has invested over £160m across 77 companies, leveraging a further £268m of capital from third party investors. Par Equity’s investment thesis is to combine the professionalism and rigour of a venture capital manager with the skills and expertise of a broad base of individual investors who can add value throughout the investment life cycle. This investment approach has produced strong and consistent returns across 30 realisations to date.

About Northstar Ventures

Northstar Ventures is a venture capital and social investment firm based in the North East. We provide funding for innovative, scalable businesses and high impact social enterprises. We’ve been supporting entrepreneurs since 2004, seeking out strong teams with great ideas that will drive high growth, scalable businesses, and sustainable charities. As the North East’s leading early stage investor, we have

invested over £100m into start-ups, early stage businesses and high impact social enterprises. Our investment managers have a wealth of experience supporting new and growing businesses and bring commercial and operational experience, PhDs and MBAs, international careers and even a micro-business or two.

Contacts:

Advanced Electric Machines: Alex Michaelides, Torque Agency Group [email protected] | +44 (0) 7802 865 732, Euan Antona, Torque Agency Group [email protected] | +44 (0) 7702 334 887

Barclays: Holly Brown, Climate Communications [email protected] | +44 (0) 7881 355 625

Legal & General Capital: Eleanor Pinnegar [email protected] | +44 (0) 7539 173 639

Par Equity: Charlotte Simpson, Words and Pixels [email protected] | +44 (0) 7531 525392